The Ultimate Guide to Investment in the Fifth Settlement 2026: Strategies for Choosing Top Projects and Maximizing Real Estate ROI

Reserve your unit now and take your first steps towards successful investment.

If you have any questions, please fill out the following form, and we will contact you as soon as possible.

Investing in fifth Settlement cities

- Investing in Fifth Settlement Cities: Your 2026 Comprehensive Guide to Achieving Peak Real Estate Returns (Section I)

- Investing in Fifth Settlement Cities (Section II): Top Compounds and Unmasking the Risks

- Investing in Fifth Settlement Cities (Section III): Future Outlook, Legal Security, and the Final Verdict

- Final Summary: The Expert’s Verdict

Own your commercial property Your administrative office Your medical clinic

In the best locations in New Cairo

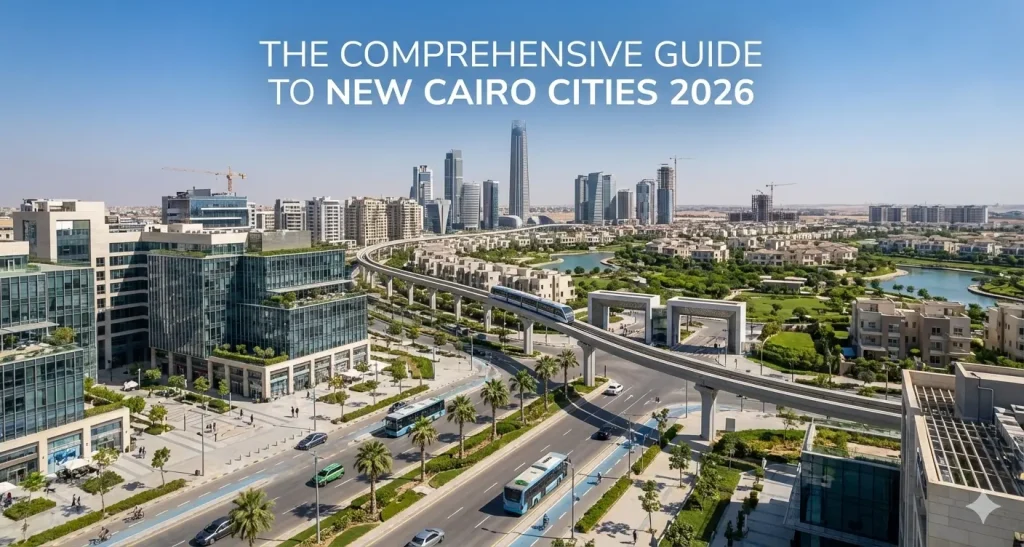

Investing in Fifth Settlement Cities: Your 2026 Comprehensive Guide to Achieving Peak Real Estate Returns (Section I)

In the midst of the rapid economic fluctuations currently shaping the global and regional landscape, the question is no longer “Should I invest my money?” but rather “Where should I place my capital to protect and grow it?” As a direct insight from my extensive experience in the Egyptian market, real estate remains the “safe haven,” and Investing in Fifth Settlement cities stands out as the crown jewel that gains luster year after year—outperforming alternatives like gold or bank certificates in the long run.

In this deep-dive guide, I won’t just give you marketing fluff. Instead, I am handing you the results of years of market analysis, comparing Investing in Fifth Settlement projects, and uncovering the secrets of districts that many investors overlook.

Why is Investing in Fifth Settlement Cities the Winning Move?

When we discuss the prospect of Investing in Fifth Settlement cities, we aren’t just talking about a residential neighborhood; we are talking about the “Strategic Backyard” of the New Administrative Capital. The Fifth Settlement is no longer the quiet suburb it was in the nineties; it has transformed into the most vibrant financial and commercial hub in Greater Cairo.

Here are the fundamental reasons why capital is flowing here:

Strategic Connectivity: Situated perfectly between “Old Cairo” (Heliopolis and Nasr City) and the New Administrative Capital. This location makes Investing in Fifth Settlement compounds the preferred choice for diplomats and executives who work in the Capital but prefer the established lifestyle of New Cairo.

Advanced Infrastructure: A massive network of roads (The Middle Ring Road, Bin Zayed Axis, Suez Road) has made reaching any destination a matter of minutes.

Portfolio Diversification: Whether you are looking for commercial, administrative, medical, or residential assets, the market here covers all demands, ensuring high occupancy rates for rentals.

High ROI: Historically, real estate prices here have seen annual increases ranging from 20% to 40%, consistently outpacing inflation.

Mapping the Territory: Understanding “Fifth Settlement Cities” and Their Districts

One of the biggest mistakes new investors make is treating the Fifth Settlement as one monolithic block. As an expert, I tell you: “The street makes the difference in price and future potential.”

To maximize your success when Investing in Fifth Settlement, you must understand the geography. Investors often refer to the main districts as the “Investing in Fifth Settlement cities.” Let’s compare the top areas to see where your money belongs:

1. The Golden Square

This is the “crème de la crème” of the market, located directly on the North 90th Street.

Why invest here?: It hosts the most prestigious Investing in Fifth Settlement projects (such as Mivida, Palm Hills, and Sodic). While the entry price is the highest, the rental yield is unmatched, as it is the first choice for expats and multinational corporations.

Preferred Investment: Luxury residential (villas) and hotel apartments.

2. Beit Al Watan

This represents the future of current investment. Located between Al Rehab and Madinaty, it serves as the direct gateway to the New Administrative Capital.

Why invest here?: It is still in its growth phase, meaning you buy at “today’s” price to sell at “tomorrow’s” value upon service completion.

Preferred Investment: Residential apartments and long-term capital appreciation.

3. Lotus District (North & South)

Located directly in front of the American University in Cairo (AUC).

Why invest here?: Student housing investment. Buying a studio here guarantees a steady stream of tenants from the university’s student body and faculty.

Comparison Table: Where Should You Allocate Your Capital?

Based on market analysis for the first quarter of 2026, here is a quick reference for Investing in Investing in Fifth Settlement:

| District / Neighborhood | Ideal Investor Profile | Expected Annual Return | Liquidity (Ease of Resale) | Required Budget |

| Golden Square | Seeking luxury & stability | High (USD Rental potential) | Very Fast | Very High ($$$$) |

| Beit Al Watan | Long-term growth seeker | Very High (on Resale) | Medium (Growth phase) | Moderate ($$) |

| Lotus District | Seeking immediate rental income | High (Student/Faculty demand) | Fast | Moderate to High ($$$) |

| 90th Street (Comm./Admin) | Large-scale Investors/Corps | Highest ROI | Very Fast | Very High ($$$$$) |

Expert Tip: If your budget allows, move immediately toward the commercial and administrative sector on 90th Street. The rental yield per square meter for commercial space often doubles that of residential, with long-term 5-to-9-year leases.

FAQ: The Basics of Investing in Fifth Settlement

As a consultant, these are the most common questions I receive daily:

Q1: Is it too late to start Investing in Fifth Settlement cities after the recent price hikes? A: Absolutely not. The golden rule of real estate is: “The best time to buy was 5 years ago; the second best time is today.” The area is in a constant state of “repricing” due to high demand and land scarcity.

Q2: Are there any Disadvantages of Investing in Fifth Settlement? A: While the pros are many, one must consider the high maintenance fees in premium compounds and the traffic congestion on 90th Street during peak hours. However, these are manageable risks if you choose the right project (We will dive deeper into the Disadvantages of Investing in Fifth Settlement in Section II).

Q3: Which is better: Residential or Commercial? A: Residential is easier to liquidate and lower risk, but Commercial/Administrative offers significantly higher yields (12-15%+) for those with a larger capital buffer.

What to expect in Section II?

We have covered the locations. In the next part, we will analyze specific Investing in Fifth Settlement compounds, the “Off-plan vs. Ready” debate, and a transparent look at the risks you need to avoid.

Investing in Fifth Settlement Cities (Section II): Top Compounds and Unmasking the Risks

Choosing the right area is only half the battle; the other half is selecting the right developer and the specific project. In 2026, the market for Investing in Fifth Settlement projects has become more sophisticated. Should you buy “Off-plan” to capture the initial price surge, or go for “Ready to Move” to secure your capital immediately?

Let’s navigate this landscape based on current market data and direct investor feedback.

Premium Selection: Top Tiers for Investing in Fifth Settlement Compounds

When we talk about Investing in Fifth Settlement compounds that have proven their investment worth—in terms of maintenance, community management, and resale value—these names stand out as “Safe Haven” portfolios:

1. Mivida – Emaar Misr

Mivida remains the “Icon” of New Cairo.

Why it’s a successful investment: It carries the “Emaar” brand equity. Their Facility Management is the best in Egypt, which maintains the building’s aesthetics and landscape, ensuring the price per meter continues to climb. Rental demand here is the highest, often paid in foreign currency by expats.

Best for: Investors seeking high-end stability and immediate, premium rental yields.

2. Mountain View iCity

A massive project that introduced the “4D City” concept. In 2026, it is a vibrant, fully serviced community.

Why it’s a successful investment: Innovation in design (like the iVilla) has made it a magnet for young families. The demand for resale here is exceptionally high due to its unique lifestyle offerings.

Best for: Mid-to-long term capital appreciation.

3. Hyde Park

Located directly on the South 90th Street, it boasts the largest central park in New Cairo.

Why it’s a successful investment: Strategic location and unit diversity. The administrative units within the “Hyde Park Business District” have seen legendary price jumps in the last two years.

Analytical Comparison: Investing in Fifth Settlement Projects (Off-Plan vs. Ready)

A critical decision when Investing in Fifth Settlement is the timing of your entry. Here is a 2026 comparison table to guide your strategy:

| Feature | Off-Plan Projects | Ready to Move Units |

| Price per Meter | 20-30% lower than current market rates. | Full market price (Premium). |

| Payment Plan | Small down payments (5-10%) with 8-10 year installments. | Large down payments (20-50%) or cash. |

| ROI Potential | High Capital Gains: You profit from the construction stages. | High Cash Flow: Immediate rental income. |

| Risk Level | Moderate (potential delivery delays). | Minimal (The asset is tangible and ready). |

| Investing in Investing in Fifth Settlement Example | New phases in “Sarai” or “Beit Al Watan.” | “Cairo Festival City” or “Al Rehab.” |

The Other Side: Disadvantages of Investing in Fifth Settlement

As a professional consultant, I must be transparent. You need to understand the Disadvantages of Investing in Fifth Settlement to mitigate risks effectively:

1. Price Saturation in Specific Pockets

Some areas in the Fifth Settlement have reached their “Price Ceiling.” Buying in these older parts of the South 90th may result in slower annual appreciation compared to “Growth Zones” like Beit Al Watan.

Solution: Look for “Growth Zones” where infrastructure is still being finalized.

2. Rising Service & Maintenance Charges

In prestigious Investing in Fifth Settlement compounds, the initial maintenance deposit is often no longer enough. Developers are now requesting additional annual fees to cover inflation and high-end service costs. This can eat into your net profit.

Solution: When calculating your ROI, always deduct 10-15% for maintenance and depreciation to find your real net yield.

3. Traffic and High Density

Despite road expansions, the 90th Street remains a bottleneck during peak hours. This may slightly impact the desirability of certain administrative offices for companies that prefer quieter, less congested peripheral locations.

FAQ: Deep Dive (Q&A) – Section II

Q4: Is Beit Al Watan a genuine opportunity or just a desert gamble? A: In 2026, Beit Al Watan is the “Black Horse.” Infrastructure is nearly complete, and its location between Al Rehab and the New Capital makes it a strategic winner. It is ideal for those who want to buy “Large Space” apartments at a price lower than the gated compounds.

Q5: Is it better to invest in Studios or Large Apartments? A: For pure investment, Studios and 1-Bedroom units are the champions. They offer higher liquidity (easier to sell), higher demand for rentals (students/expats), and the highest rental return relative to the unit’s purchase price.

What’s Next in Section III?

We’ve analyzed locations, projects, and risks. In the final section, we will provide the “Action Plan”:

Legal procedures for safe registration in 2026.

The impact of the New Administrative Capital on future prices.

The final expert verdict: How to build your New Cairo portfolio.

Ready for the final roadmap? Let’s move to Section III.

Investing in Fifth Settlement Cities (Section III): Future Outlook, Legal Security, and the Final Verdict

In the world of real estate, “entry” is easy, but “exiting with a profit” is the real game. As an expert who has navigated the shifts of the Egyptian market for years, I assure you that Investing in Fifth Settlement cities is not just about buying a unit; it is about owning a stake in the future of New Cairo.

In this final section, we answer the ultimate question: Where is the market heading now that the New Administrative Capital is fully operational? And how do you legally bulletproof your investment?

I. The Future of the Settlement in the “New Republic” Era (Vision 2030)

There is a common misconception that the New Administrative Capital (NAC) will steal the spotlight from the Fifth Settlement. My analysis of the 2026 market trends shows the opposite for several reasons:

The Settlement as the “Residential Downtown”: While the NAC is the hub for government and massive financial districts, the Investing in Fifth Settlement compounds remain the preferred “Lifestyle Hub.” High-ranking officials and CEOs working in the NAC often choose to live in the established, lush communities of the Fifth Settlement.

Scarcity of Land: The Fifth Settlement is almost “built out.” There are no more massive land plots for new mega-projects in the heart of the city. Economics 101: “When supply (land) decreases, value increases.”

The Monorail & Connectivity: The completion of the Monorail and Electric Train (LRT) has bridged the gap, making the commute between Investing in Fifth Settlement projects and the NAC a matter of 15 minutes. This connectivity has solidified the Settlement as the most strategic “suburb” of the Capital.

The Verdict: Investing in Fifth Settlement cities now is an investment in “Scarcity”—a location that cannot be replicated.

II. The Safe Purchase Checklist: Protecting Your Capital

Before signing any contract, whether in a new launch or a resale unit, you must go through this checklist to avoid legal loopholes.

Table: Pre-Purchase Due Diligence (2026)

| Step | Required Action | Priority Level |

| 1. Title Deed Verification | Review the “Ownership Chain” and the land allocation letter from the New Urban Communities Authority (NUCA). | 🔴 Critical |

| 2. Financial Standing | Ensure the land is fully paid for and not mortgaged to a bank. Buying on mortgaged land is a high risk. | 🔴 Critical |

| 3. Ministerial Decree | Verify the issuance of the Ministerial Decree and building permits for the specific phase you are buying into. | 🔴 Critical |

| 4. Loading Ratio | Check the “Net Square Meter” vs. “Gross.” Typical loading is 20-25%. Avoid ratios exceeding 30%. | 🟡 High |

| 5. Exit Strategy Plan | Calculate the resale potential. Is the unit “Prime” (View, Floor, Orientation)? | 🟡 High |

III. Exit Strategies: When and How to Sell?

Successful Investing in Investing in Fifth Settlement requires knowing when to harvest your profits.

1. The “Buy & Hold” Strategy

-

The Goal: Rental income + Capital appreciation.

-

Optimal Exit: After 7–10 years. Real estate moves in cycles, and holding through the initial 5 years allows you to bypass the initial costs and benefit from the area’s full maturity.

2. The “Flipping” Strategy

-

The Goal: Quick profit from the “Over Price.”

-

The Warning: This requires buying during a “Launch” (Phase 1) and selling as soon as the project reaches 40% construction. In 2026, ensure the project has “Real Demand” and isn’t just a bubble of speculative resellers.

IV. Final Expert Q&A: Closing the File

Q7: Should I invest in the Fifth Settlement or Sheikh Zayed? A: Both are excellent, but for different goals. Investing in Fifth Settlement cities typically offers higher rental demand from multinational corporations and expats due to its proximity to the airport and the NAC. Sheikh Zayed is often preferred by those looking for a quieter, family-oriented lifestyle.

Q8: How can I overcome the “Disadvantages of Investing in Fifth Settlement” regarding resale difficulty? A: The secret is “Pricing” and “Uniqueness.” Don’t be greedy with the “Over Price.” A fairly priced unit in a prime location (facing a garden or a North-facing “Bahary” orientation) will always sell faster than a poorly located unit at a discount.

Q9: Is furnished rental truly more profitable? A: Yes. In 2026, the demand for furnished studios in the Fifth Settlement is at an all-time high. Furnished units can generate 15-20% annual returns compared to just 5-7% for unfurnished ones.

Final Summary: The Expert’s Verdict

Dear Investor,

We have dissected the New Cairo market from top to bottom. Investing in Fifth Settlement cities in 2026 remains a golden opportunity, but it is no longer a game for amateurs. The market has matured, and success now requires a sharp eye for detail.

My Final Advice:

-

Don’t Wait: In real estate, waiting almost always means buying at a higher price later.

-

Define Your Goal: Are you looking for “Cash Flow” (Rental) or a “Wealth Store” (Land/Capital Gain)?

-

Diversify: Don’t put all your capital into a single project.

-

The “Safe Haven”: Real estate in the Settlement is like a “loyal son”—it might get sick (market stagnation), but it never dies (never loses its intrinsic value).

If you are looking for an investment that protects your money from inflation, provides social prestige, and generates a steady income, Investing in Fifth Settlement projects is your safest bet.

The Comprehensive Guide is now complete. I hope this serves as your roadmap to a successful and prosperous investment journey in New Cairo.

Let's discuss your next move >

Our specialized team will contact you ASAP.