The Ultimate Guide 2026: Everything You Need to Know About the New Administrative Capital (Investment, Housing, Pros, and Cons)

Reserve your unit now and take your first steps towards successful investment.

If you have any questions, please fill out the following form, and we will contact you as soon as possible.

The Ultimate Guide to New Cairo Cities

Introduction: Why New Cairo is Not Just a City, But a Lifestyle Revolution

Welcome, dear reader and investor. As a consultant and expert in the Egyptian real estate market, and specifically in the heart of its major urban transformations, I am pleased to present you with this comprehensive guide. I have carefully analyzed the market and competitors to ensure you get the most accurate and up-to-date information to help you make your decision, whether for living or investing.

Given the immense volume and importance of the information, I have divided this article into three main sections to make it easier to read and digest. In this first section, we will lay the foundation by exploring the big picture of the project, comparing its neighborhoods, and candidly discussing both the positives and the challenges.

Comprehensive Introduction: Why Are We Talking About the New Administrative Capital?

The term new administrative capital is no longer just ink on paper or a distant futuristic project; today, it has become a tangible reality reshaping Egypt’s economic and urban map. Located in the Cairo Governorate, specifically on the borders of Badr City in the area between the Cairo-Suez and Cairo-Ain Sokhna roads, this mega-project is already coming to life.

This smart city was designed to be the new heartbeat of the Egyptian government and the premier financial and business hub in the Middle East. With the relocation of ministries and government institutions, the eyes of major investors and citizens have turned toward real estate in the New Administrative Capital, searching for a golden opportunity in what is considered the largest project in Egypt’s modern history.

However, as a real estate expert, I always tell my clients: “There is no such thing as a 100% perfect project.” Therefore, we must study the market carefully and know exactly when, how, and where to place our money. In this article, I will take you on a professional and entirely objective tour, exploring every angle with complete neutrality.

- Part One: Exploring the City, Pros and Cons, and Neighborhood Comparison

- Part Two: Your Practical Guide to Buying Real Estate in the New Administrative Capital and the Secrets to Successful Investment

- Part Three: The Comprehensive Living Guide and the Future of the New Administrative Capital

- Conclusion

Own your commercial property Your administrative office Your medical clinic

In the best locations in New Cairo

Part One: Exploring the City, Pros and Cons, and Neighborhood Comparison

1. Advantages of the New Administrative Capital (Why buy here?)

If you are seriously considering investing in the New Administrative Capital or moving there to live, here are the standout features that make this project truly exceptional:

Smart Infrastructure: The capital is designed as a fourth-generation (Smart City). Everything is managed electronically, from traffic systems and waste recycling to electricity grids and high-speed internet (fiber optics).

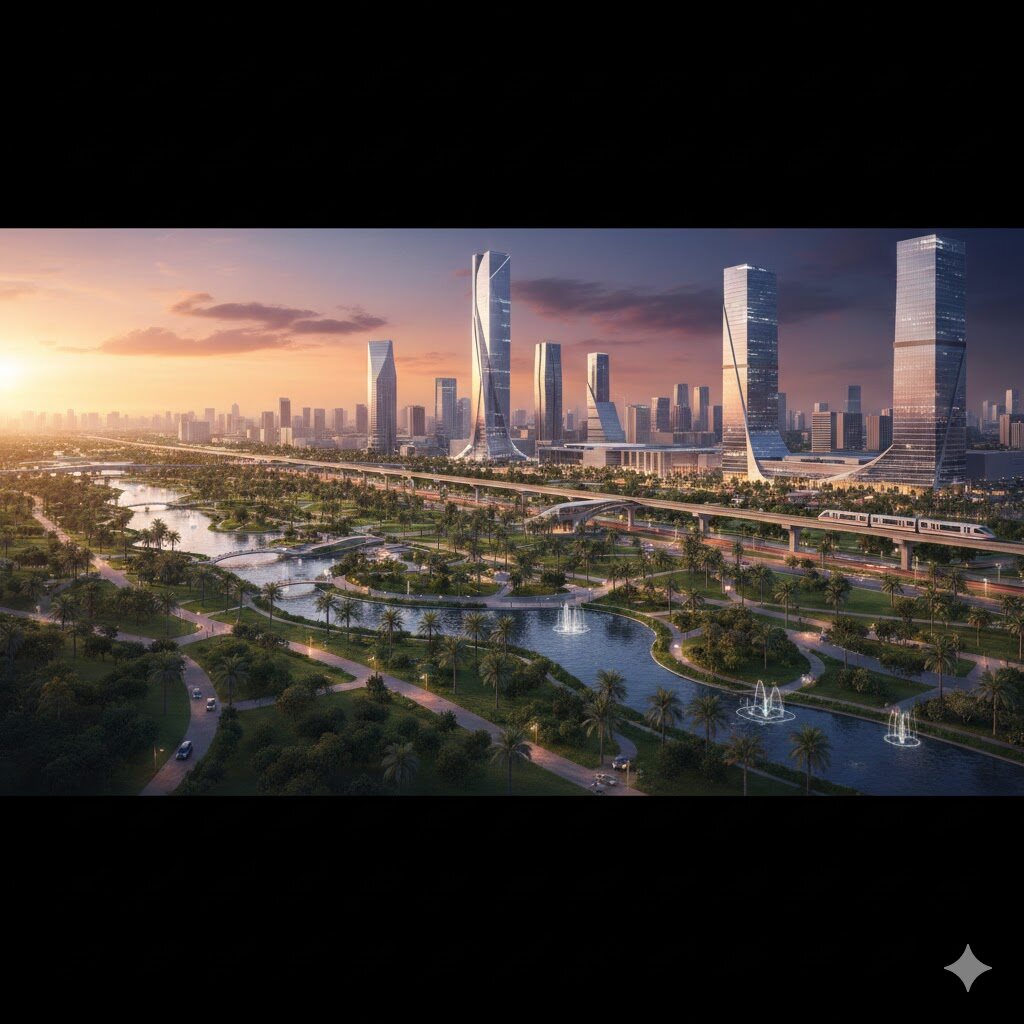

The Green River: The longest chain of parks in the world, stretching from the beginning of the capital to its end, providing a natural breathing space and enchanting views for most residential and commercial projects.

Integrated Transportation Network: The Light Rail Transit (LRT), the Monorail, and a massive network of roads connect the capital to all parts of Greater Cairo and neighboring governorates, completely eliminating the idea of isolation.

Diverse Real Estate Opportunities: Whether you are looking for a residential apartment, a luxury villa, a medical clinic, or an administrative office in a skyscraper, the real estate in the New Administrative Capital offers options that suit all budgets and needs.

Safety and Privacy: The city is fully covered by surveillance cameras and advanced security systems managed from a central command and control center.

2. Disadvantages of the new administrative capital (Challenges you must know)

As a real estate consultant who prioritizes your best interests, I must be completely honest with you. There are a few challenges or disadvantages of the new administrative capital that you must take into account before making your decision:

High Prices: Due to the scale of development and premium services, real estate prices are considered relatively high compared to other new cities (like the Fifth Settlement or 6th of October), which may make it inaccessible for certain demographics.

The City is Still Under Development: Despite massive achievements, the capital is a project that spans many years. Some neighborhoods are still active construction sites (especially in the later phases), meaning immediate residency in some areas might lack fully completed commercial and recreational services nearby.

Distance from the Old Downtown: For individuals whose daily, continuous work is tied to the old downtown Cairo or Giza, the daily commute might present a challenge, despite the presence of the Monorail and the LRT.

3. Professional Comparison Between Neighborhoods

To make the real estate map easier to understand, I have prepared this table that summarizes and compares the most important residential and investment neighborhoods in the capital:

| Neighborhood / Area | Main Classification | Key Features | Who is this neighborhood for? |

| Seventh Residential District (R7) | Residential & Investment (Compounds) | The most densely populated in terms of projects; contains international universities and hospitals. Construction rates are almost complete. | Families looking for upscale housing and investors seeking a quick rental return. |

| Eighth Residential District (R8) | Luxury Residential | Features wider green spaces, lower population density, and overlooks the Green River and the Aviation Club directly. | Those seeking absolute tranquility, high privacy, and top-tier luxury. |

| Central Business District (CBD) | Commercial, Administrative, Hotel | Houses the Iconic Tower (the tallest in Africa) and world-class skyscrapers. A major financial center of gravity. | Major corporations and investors looking for administrative and commercial units with massive ROI. |

| Financial and Business District | Administrative / Financial | Headquarters for central and international banks, the Egyptian Stock Exchange, and major corporate HQs. | Businessmen and investors in the financial and banking sectors. |

| Government and Diplomatic District | Administrative / Political | Houses ministries, the parliament, and foreign embassies. Built with the highest security standards. | Indirectly raises the investment value of adjacent areas (like the MU23 area). |

4. Questions and Answers (FAQ) from My Market Experience

In every consultation session with my clients, certain core questions repeatedly come up. Here are the most important ones along with comprehensive answers:

Q1: Is the current time suitable for investing in the New Administrative Capital, or am I too late? A1: The current time is the “golden window” for the second phase. Those who bought in 2018 have doubled their profits, but with the official relocation of the government and the operation of the electric train, we are witnessing a real increase in rental and operational value. Investing in the New Administrative Capital today is about “operation” and ROI, not just “preserving the value of money.”

Q2: Which is better for investment: commercial or residential real estate in the capital? A2: Commercial real estate (shops and malls) in areas like the CBD or the Downtown area yields a higher and faster rental return (ROI can reach 10-15%). Residential property, on the other hand, is a safe, long-term investment characterized by continuous demand, especially in R7 and R8. The choice depends entirely on your budget and your specific investment goal.

Q3: Are there strict conditions for building or finishing in the capital? A3: Yes, and this is actually one of the most important advantages, not a disadvantage! The Administrative Capital for Urban Development (ACUD) imposes strict oversight on real estate developers to ensure adherence to delivery dates, facade quality, and the unification of the smart architectural character. This heavily protects your investment from future disorganization or slums.

Part Two: Your Practical Guide to Buying Real Estate in the New Administrative Capital and the Secrets to Successful Investment

Welcome back, dear investor. After laying the foundation in the first part for understanding the map of the new administrative capital and reviewing its most prominent residential neighborhoods, we now move to the heart of the investment battlefield. As a real estate consultant, I see investors making excellent profits every day, while others stumble due to poor choices. In this section, I will give you the essence of my market experience for 2026, ensuring you know exactly how to choose your property smartly.

1. The Diversity of Real Estate in the New Administrative Capital (Where should you put your money?)

The market for real estate in the New Administrative Capital is characterized by a massive diversity that you won’t find in any other Egyptian city. This diversity creates phenomenal opportunities, but at the same time, it requires precision in selection. Investment opportunities are divided into four main sectors:

Commercial Sector (Shops and Malls): Considered the highest in terms of Return on Investment (ROI). Investing in commercial units requires a careful study of the mall’s location, surrounding population density, and type of activity. The best areas currently are the Downtown area and the Shopping and Entertainment District.

Administrative Sector (Offices and Companies): With the relocation of government agencies and major corporations, the demand for administrative offices has surged, especially in the Financial and Business District and the Central Business District (CBD). This sector is characterized by tenant stability (companies usually rent for long periods ranging from 3 to 5 years or more).

Medical Sector (Clinics and Centers): A vital and always-demanded sector. It is highly preferable to invest in specialized medical complexes or malls that allocate isolated floors for clinics, ensuring strict compliance with Ministry of Health regulations.

Residential Sector (Apartments and Villas): The safe haven. The rental yield is lower than that of commercial and administrative properties, but the rate of capital appreciation is excellent, especially in fully serviced residential neighborhoods like R7.

2. Comparing Investment Zones (Commercial and Administrative)

Continuing our neighborhood comparison from the first part, let’s now compare the most prominent areas designated for commercial and administrative investment to determine the most suitable destination for your budget:

| Investment Zone | Nature of the Area | Expected Cost | Advantages of the New Administrative Capital in this area | Who do we recommend it for? |

| Downtown | The commercial and entertainment heart | Medium to High | Massive diversity in unit sizes, contains specialized markets (Gold Market, Tech Market), close to Al Masa Hotel and the Monorail. | Small and medium investors looking for diversity and quick rental returns for smaller commercial units. |

| Al Amal Axis (MU23) | Mixed-Use area | Medium | Located between residential districts R2 and R3 (currently the highest density), ensuring immediate commercial and medical operation. | Investors looking for quick operation due to the surrounding population density. |

| Central Business District (CBD) | Skyscrapers and iconic towers | Very High | World-class management, unprecedented architectural designs, and headquarters for multinational companies. A global investment facade. | Major investors and companies looking for luxury administrative headquarters or shops for global brands. |

3. Secrets of Investing in the New Administrative Capital (How to Avoid Losses)

Despite the numerous advantages of the New Administrative Capital, making the wrong investment might force you to face one of the worst disadvantages of the new administrative capital, which is dealing with a “stumbling real estate developer.” To avoid this trap, follow these golden rules:

Developer’s Track Record: Don’t buy “promises on paper.” Ensure the development company has a solid history of delivering actual projects (whether inside the capital or outside, like in New Cairo or the North Coast).

Legal Documents (Ministerial Decree): Do not sign any contracts before ensuring the project has obtained the official ministerial decree and building permits from the Administrative Capital for Urban Development (ACUD) company.

Facility Management Company: In commercial and administrative real estate, the developer builds, but the management company operates and brings in the top brands. The success of your investment depends 70% on the strength and reputation of the management company.

Load Factor: Beware of exaggerated load factors (the difference between the gross area you pay for and the net usable area of the unit). Make sure the net area is clearly written and stipulated in the contract.

4. Consulting Q&A (Part Two)

To deepen our understanding, let’s continue answering the most pressing questions from the reality of the 2026 market:

Q4: Is buying an “under construction” unit better than “immediate delivery” right now? A4: We are now in an advanced stage of the new administrative capital. If your goal is a quick ROI and protecting your money from inflation, then “immediate delivery” or delivery within a few months is your best bet, so you can lease it out right away. However, if your budget is limited and you are looking for long payment plans reaching 8 or 10 years, the “under construction” option in newer phases is still available and profitable, though it requires patience.

Q5: I hear a lot about “mandatory rent” or “return on down payment,” are these real offers? A5: As a real estate expert, I advise you to be extremely cautious. Some reliable developers offer these genuinely and with sound financial backing to encourage investing in the New Administrative Capital, but others might use them merely as a “marketing gimmick” by inflating the original price per square meter to cover this supposed return. Carefully study the price per meter in neighboring projects that do not offer these deals for an accurate comparison. Ultimately, the unit’s location and its real ability to attract tenants are far more important than a mandatory rent clause.

Part Three: The Comprehensive Living Guide and the Future of the New Administrative Capital

Welcome to the concluding part of our comprehensive guide. After exploring the construction map and investment opportunities in the previous sections, we dedicate this final part to the human and operational aspect: What will daily life be like in the new administrative capital? And how can you ensure that your decision today becomes a secure legacy for your children tomorrow? As a real estate expert, I will take you behind the scenes of housing, services, and the future outlook for prices.

1. Quality of Life: Education and Health Services

What distinguishes real estate in the New Administrative Capital is not just the concrete walls and modern designs, but the integrated service ecosystem surrounding them. The city is designed as a “15-minute city,” where no vital facility is more than a fifteen-minute walk or drive away.

International Education: The capital already hosts the “Knowledge Hub” (including the Canadian University) and the “European Universities in Egypt” (EUE), alongside numerous international schools (IG and American) that have already begun welcoming students. This makes living in districts like R7 a strategic choice for families.

Medical Care (Medical City): “Capital Med” is a world-class medical landmark featuring specialized hospitals and research centers, eliminating the need to travel to old Cairo for high-end healthcare.

Entertainment and Culture: The advantages of the New Administrative Capital extend beyond work; the “City of Arts and Culture” (featuring the new Opera House) and “People’s Square” provide residents with a sophisticated cultural and entertainment lifestyle.

2. Future Real Estate Prices (Projections 2026–2030)

As a market expert, I assure you that the price curve in the capital has not yet reached its peak. Here are the reasons that will lead to an upcoming price jump:

Full Governmental Operation: With the relocation of thousands of employees and their settlement in the dedicated “Employee Housing” in Badr City and the Third Residential District (R3), the demand for commercial and retail services in the heart of the capital will skyrocket.

The Monorail and LRT Impact: Ease of access directly correlates with demand. Increased demand inevitably leads to higher prices for real estate in the New Administrative Capital.

Scarcity of Prime Land: Prime lands in the first phase are almost exhausted. Future phases (Second and Third) will be launched at much higher entry prices due to increased construction costs and raw materials.

3. Final Comparison: Living in a Private Compound vs. Governmental Districts

Many clients ask me: “Should I buy in the ready-to-move R3 district or wait for a private compound in R7?” Here is the professional breakdown:

| Comparison Point | Governmental Districts (R3 / R2) | Private Compounds (R7 / R8) |

| Move-in Readiness | Immediate; services are already operating. | Requires 1 to 3 years for full operation. |

| Privacy | Moderate; similar to organized traditional neighborhoods. | Very high; gated with private security and internal landscaping. |

| Facilities | Public (street-level parking). | Private (underground parking, clubhouses, swimming pools). |

| Investment Value | Stable and steady growth. | Major price leap upon project completion. |

4. Final Q&A (FAQ)

Q6: What is the biggest concern for buyers regarding the disadvantages of the new administrative capital today? A6: The biggest concern is “delivery delays.” Some companies were affected by global inflation and slowed down production. Therefore, the golden advice is: “Buy in a project where the construction rate has exceeded 40% on the ground” to minimize risks.

Q7: Is investing in the Capital better than the Fifth Settlement? A7: The Fifth Settlement is a mature and fully occupied area; its price increase is stable. However, investing in the New Administrative Capital is an investment in “The Future.” The Capital is the new administrative and political seat of the state, giving it a massive long-term competitive edge in terms of global demand and prestige.

5. SEO Expert Tips for Real Estate Content

Since you aim to top Google search results, here are the professional secrets:

Updated Data: Google rewards fresh content. Always include current price-per-meter rates (which change quarterly).

Original Imagery: Don’t just use “renderings”; include real photos from the construction sites.

Internal Linking: Link your article to specialized pages on your site (e.g., a specific article about the Downtown area).

User Experience: Keep the article scannable using tables and bullet points as we did here to reduce your “Bounce Rate.”

Conclusion

In conclusion, the decision to purchase a property in the new administrative capital is a step toward the future in every sense of the word. We have explored the advantages of the New Administrative Capital that make it a global destination, and we haven’t shied away from clarifying the disadvantages of the new administrative capital with full transparency.

Remember, “Real estate may get sick, but it never dies.” In a city the size of the Capital, real estate is the “winning horse” in the race to preserve and grow financial value. Whether you are looking for a luxury home, an administrative office, or a long-term investment, the opportunities are still there—they just require an honest consultant, a bold heart, and careful study.

Let's discuss your next move >

Our specialized team will contact you ASAP.